An insurance lead is an individual or company that has expressed an interest in purchasing an insurance policy. This expression of interest can take various forms, such as filling out an online form, a telephone call or a quote request. Leads are crucial for insurance companies because they represent potential sales opportunities.

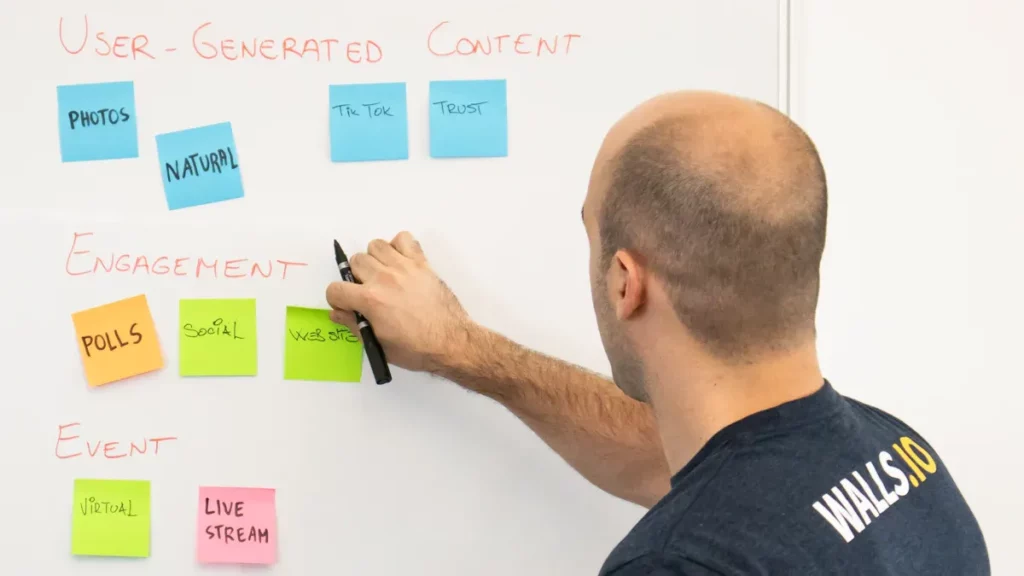

Insurance lead generation can

1. Online advertising campaigns

2. Partnerships with related websites or companies

3.

Recommendations from existing customers

Once a lead has been identified, it's essential to follow up closely and provide them with the information and advice needed to help them make an informed decision about insurance. Insurance agents and brokers use these leads to expand their client portfolio and increase sales. Lead quality is a key factor in maximizing the chances of converting them into customers.

A quality lead generally has a higher level of interest and a greater likelihood of closing an insurance contract. In conclusion, an insurance lead is a key element of the sales process in the insurance sector, representing a commercial opportunity for companies and professionals in the field.

Summary

- An insurance lead is an individual or business that has expressed an interest in purchasing an insurance policy.

- The benefits of buying insurance leads include quick access to potential customers and the ability to target specific segments of the market.

- Different methods for purchasing insurance leads include direct purchasing, partnering with lead providers, and using online platforms.

- To choose the right insurance lead provider, it is important to check the quality of the leads, the guarantees offered and the reviews of other customers.

- Best practices for converting leads into insurance customers include following up quickly, personalizing the offer, and maintaining regular communication.

- The mistakes to be avoided when purchasing the insurance leads are to neglect the quality of the leads, not to establish clear criteria and not to measure the results.

- Conclusion: the importance of the quality of insurance leads is essential to maximize the chances of conversion and customer loyalty.

The advantages of buying insurance leads

Save time and money

Buying insurance leads has many advantages for agents and insurance brokers. First of all, it saves time and money by avoiding the need to generate leads by yourself. By buying leads, insurance professionals can focus on conversion of prospects to customers rather than the search for new leads.

Increase sales and develop the customer portfolio

In addition, buying insurance leads allows you to obtain a constant flow of qualified prospects, which can help increase sales and develop the customer portfolio. In addition, the purchase of insurance leads can offer a competitive advantage by allowing agents and brokers to access prospects that may not be available by other means.

Diversify the customer portfolio

Additionally, buying insurance leads can help diversify the customer portfolio by targeting specific market segments or particular insurance product types. In summary, the benefits of buying insurance leads include saving time and money, access to a constant flow of qualified prospects, competitive advantage, and the ability to diversify the customer portfolio.

The different methods for buying insurance leads

There are several methods to buy insurance leads, each with its own advantages and disadvantages. First, agents and brokers can buy leads from suppliers specializing in the insurance leads These suppliers often use online marketing techniques such as paid advertising, natural referencing or social media to generate qualified leads .

By purchasing leads from these providers, insurance professionals can benefit from a steady stream of prospects interested in insurance products. Another method to buy insurance leads is to partner with companies or websites that generate leads in related fields. For example, an auto insurance agent could partner with a car dealership to obtain leads interested in auto insurance.

This method can be particularly effective for targeting specific market segments and obtaining highly qualified leads. Finally, agents and brokers can also purchase leads from or exchange leads with other insurance professionals. This method can be useful for obtaining leads in specific geographic regions or for diversifying the customer portfolio.

How to choose the right insurance lead provider

| Selection criteria | Importance | Assessment |

|---|---|---|

| Lead quality | Very important | Evaluate the relevance and reliability of the leads provided |

| Experience in the insurance industry | Important | Check experience and knowledge of the insurance market |

| Cost of leads | Important | Compare costs by Lead and assess the return on investment |

| Customer support and service | Important | Check the quality of support and customer service offered |

| Integration with existing tools | Moderate | Check compatibility and integration with existing management tools |

Choosing the right insurance lead provider is crucial to ensuring the quality and relevance of the leads obtained. First, it’s important to look for reputable and reliable providers who have a proven track record in insurance lead generation. It is recommended to check references and testimonials from other customers to ensure that the provider has a good reputation and provides quality leads.

Next, it is essential to ensure that the leads provided are truly qualified and relevant to the insurance business in question. This may involve asking questions about how leads are generated, the criteria used to qualify prospects, and how information is verified and updated. Additionally, it is important to ensure that the supplier complies with data protection and privacy regulations, to ensure that leads are obtained legally and ethically.

Finally, it is recommended to test different suppliers and types of leads to find the one that best suits specific needs. It may be useful to start by buying a small number of leads to assess their quality and conversion rate before engaging in a larger purchase. In summary, choosing the right insurance supplier in insurance involves looking for the supplier's reputation and experience, to ensure that leads are qualified and relevant, and to comply with data protection regulations.

Best practices for converting leads into insurance customers

Converting leads into insurance customers requires a strategic and well-thought-out approach. First of all, it is essential to quickly follow up on leads as soon as they are received in order to maintain their interest and prevent them from turning to the competition. This may involve the use of automated systems such as email auto-responses or telephone reminders to ensure quick and effective follow-up.

Next, it is important to personalize communication with each lead to address their specific needs and concerns. This may include sending relevant information about insurance products that match the lead's needs, as well as providing personalized advice to help them make an informed decision. Additionally, it is recommended to establish trust with leads by being transparent about the products and services offered, as well as providing excellent customer service throughout the process.

Finally, it's crucial to regularly track progress with each lead and adjust your strategy as needed to maximize your chances of conversion. This may involve tracking interactions with the lead, measuring the conversion rate at each stage of the process, and analyzing why some leads don't convert. In summary, best practices for converting insurance leads into customers include prompt follow-up, personalized communication, building trust, and regularly tracking progress.

Mistakes to avoid when buying insurance leads

Quality before quantity

First of all, it's crucial not to focus solely on the quantity of leads at the expense of their quality. Buying a large number of low-qualified leads can result in wasted time and money trying to convert prospects who aren't really interested in the insurance products being offered.

Reliable lead sources

Next, it's important to avoid buying leads from unreliable or unscrupulous sources that might violate data protection regulations or use deceptive practices to generate leads. This could not only compromise the legality and ethics of the leads obtained, but also damage the reputation and credibility of the insurance professional using them.

Lead tracking and management

Finally, it is crucial to avoid ignoring or neglecting the monitoring and management of leads once they have been purchased. Inadequate follow -up or poor management of leads can lead to a loss of potential sales opportunities and compromise the return on investment made in the purchase of leads.

Conclusion

In summary, when purchasing insurance leads, it is important to avoid focusing solely on quantity at the expense of quality, to avoid unreliable or unscrupulous sources, and to avoid ignoring the follow-up and management of leads once they have been purchased.

the importance of lead quality in insurance

In conclusion, insurance leads represent a valuable opportunity for insurance agents and brokers to increase their sales and develop their customer portfolio. Buying insurance leads can offer several benefits such as saving time and money, access to a constant flow of qualified prospects, a competitive advantage and the possibility of diversifying the customer portfolio. However, it is crucial to choose the right insurance lead provider in order to obtain qualified and relevant leads, while avoiding some common mistakes such as focusing only on quantity at the expense of quality.

Additionally, converting leads into insurance customers requires a strategic approach including rapid follow-up, personalized communication, establishing a relationship of trust and regularly monitoring progress. Ultimately, the importance of insurance lead quality cannot be overstated, as it can have a significant impact on insurance professionals' business success and customer portfolio growth.

If you are looking to buy insurance leads, you might also be interested in this article on listing B2B companies for your prospecting. This resource from Magileads offers helpful tips for finding potential companies to target in the insurance industry. Using this list, you may be able to generate high-quality leads for your business. View the full article here .

FAQs

What is an insurance lead?

An insurance lead is a person or company that has expressed an interest in an insurance product or service. This may include completing an online form, making a phone call, or any other action demonstrating interest in insurance.

Why buy insurance leads?

Buying insurance leads allows insurance companies to expand their potential customer base and increase their sales opportunities. It can also be an effective way to target qualified prospects interested in specific insurance products.

How to buy insurance leads?

There are several ways to purchase insurance leads, including through specialist lead providers, using online platforms, or developing partnerships with other companies or brokers.

What are the benefits of buying insurance leads?

Buying insurance leads can save insurance companies time and resources by targeting qualified prospects, which can increase the chances of conversion and sales. It can also help expand the potential customer base and boost business growth.

What are the disadvantages of buying insurance leads?

The disadvantages of buying insurance leads can include high costs, variable quality of purchased leads, and competition with other insurance companies to reach and convert these leads. It is also important to ensure that purchased leads comply with data protection and privacy regulations.