When purchasing insurance leads, it is crucial to identify the company's specific needs. This includes analyzing the types of insurance offered (auto, home, life, health, etc.), the company's size, growth objectives, and the budget allocated to lead acquisition. This understanding allows for a more effective selection of lead sources and appropriate purchasing methods.

Considering the market context is also important. In a competitive market, a more aggressive approach may be necessary for lead generation. Conversely, a niche market may require a more targeted strategy to reach the intended audience.

Accurately assessing the company's needs and the market environment allows for informed decisions in the lead generation process . This strategic approach optimizes the effectiveness of investments in acquiring potential customers and contributes to the company's growth.

Summary

- Understanding the needs of your insurance company

- Identify insurance lead sources

- Choosing the best method for buying leads

- Evaluate the quality of insurance leads

- Implement an effective monitoring process

Identify insurance lead sources

The different sources of leads

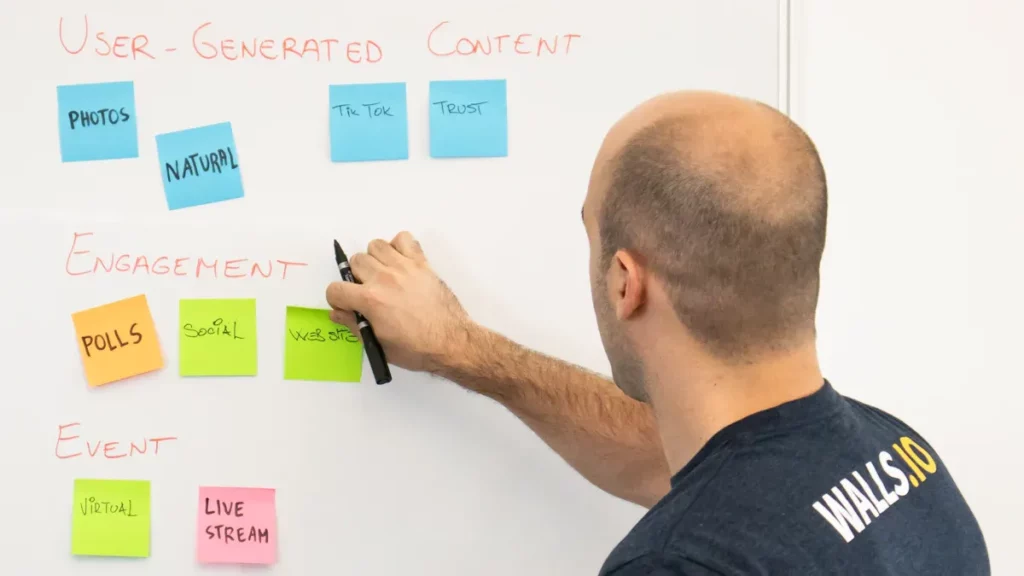

There are several ways to acquire leads, including purchasing leads from specialized providers, generating leads internally, using social media and online advertising, or participating in trade shows and professional events. Each lead source has its own advantages and disadvantages, and it's important to evaluate each option based on your company's specific needs.

The advantages and disadvantages of each source

Purchasing leads from specialized providers can be an attractive option for businesses looking to quickly acquire a large number of qualified leads. However, choosing reliable and reputable providers is essential to ensure lead quality. lead generation can be a cost-effective option in the long run, but it requires ongoing effort to create and maintain effective lead generation strategies.

Choosing the best method for your business

Finally, using social media and online advertising can be an effective way to reach a wide audience, but it requires digital marketing expertise to achieve optimal results. By identifying potential sources of insurance leads, you will be able to choose the best lead generation method for your business.

Choosing the best method for buying leads

Once you've identified potential sources of insurance leads, it's time to choose the best lead acquisition method for your business. This decision will depend on several factors, including your business objectives, budget, and the quality of leads you're looking for. If you're looking to quickly acquire a large number of qualified leads, purchasing leads from specialized providers may be the best option.

However, due diligence is essential when selecting suppliers to ensure lead quality. If you have internal resources dedicated to lead generation, developing lead generation strategies can be a cost-effective long-term option. This may involve using tactics such as email marketing, organic SEO, or creating engaging content to attract qualified prospects.

Finally, if you're looking to reach a broad audience and strengthen your online presence, using social media and online advertising can be an effective strategy. By choosing the best lead generation method for your business, you'll be able to achieve your business goals while maximizing your return on investment .

Evaluate the quality of insurance leads

| Source of leads | Number of leads | Conversion rate |

|---|---|---|

| Website | 150 | 12% |

| Social networks | 80 | 8% |

| Email marketing | 100 | 10% |

When purchasing insurance leads, it's essential to assess their quality to ensure you're investing in qualified prospects likely to convert into customers. Lead quality can vary depending on the source, the supplier's qualification process, and the lead's demonstrated level of interest. Establishing clear criteria for evaluating lead quality and working closely with your suppliers is crucial to ensuring the leads meet your requirements.

Some key indicators to consider when assessing lead quality include the level of interest demonstrated by the lead, the lead's relevance to your insurance offerings, and the accuracy of the information provided. By evaluating these factors, you will be able to identify the most promising leads and allocate your resources effectively to maximize your conversion rates. By assessing the quality of insurance leads, you will be able to optimize your lead generation process and improve your business results.

Implement an effective monitoring process

Once you've acquired insurance leads, it's essential to implement an effective follow-up process to maximize your conversion rates. This involves establishing systems to track and manage incoming leads, as well as qualifying them and distributing them to the appropriate members of your sales team. An effective follow-up process can help ensure that no qualified lead is overlooked and that each prospect receives personalized attention to encourage conversion.

It's also important to use technological tools such as customer relationship management (CRM) systems to effectively track and manage leads. CRMs can help automate certain lead-related tasks, such as automatically sending personalized emails or monitoring interactions with prospects. By implementing an effective tracking process, you'll be able to optimize your lead acquisition efforts and improve your conversion .

Measuring the return on investment of insurance leads

When investing in insurance lead generation, measuring return on investment (ROI) is essential to assess the effectiveness of your efforts. This involves establishing clear metrics to track the performance of acquired leads, such as conversion rate, cost per acquisition, and customer lifetime value. By measuring these metrics, you'll be able to evaluate the effectiveness of each lead source and allocate your resources efficiently to maximize your ROI.

It's also important to assess the quality of leads to determine their long-term value to your business. Some leads may have a higher lifetime value than others due to their long-term loyalty or propensity to purchase additional products. By measuring the ROI of insurance leads, you'll be able to optimize your lead generation strategies and improve your business results.

Optimize your insurance lead generation strategy

Finally, once you've measured the ROI of your insurance lead generation efforts, it's important to continuously optimize your strategy to improve your business results. This might involve adjusting the sources you use to acquire leads, improving your lead qualification process, or using more targeted marketing tactics to reach your target audience. By optimizing your insurance lead generation strategy, you'll be able to improve your operational efficiency and increase your long-term profitability.

It is also crucial to establish open communication with your lead providers to share feedback and collaborate on the continuous improvement of lead quality. By working closely with your providers, you will be able to optimize your lead acquisition process and improve your business results. By continuously optimizing your insurance lead purchasing strategy, you will be able to increase your competitiveness in the market and achieve your long-term business objectives.

If you're looking to improve your email marketing strategy to attract leads in the insurance industry, you should take a look at this article on educational content marketing . It will help you understand how to create relevant and informative content to capture the attention of your prospects. You can access it at this link .

FAQs

What is an insurance lead?

An insurance lead is a person or company that has expressed an interest in purchasing insurance. This could be a request for a quote, a request for information, or any other action indicating an interest in insurance.

Why buy insurance leads?

Buying insurance leads allows insurance companies to obtain qualified prospects interested in their products. This can help increase sales and grow their customer base.

How to buy insurance leads?

There are several ways to buy insurance leads. Companies can work with lead providers, use online platforms, or set up targeted advertising campaigns to generate qualified leads.

What are the advantages of buying insurance leads?

Buying insurance leads allows insurance companies to target qualified prospects, increase their chances of conversion, reduce the time and effort needed to find new customers, and optimize their marketing budget.

What are the risks associated with buying insurance leads?

The main risks associated with buying insurance leads are the quality of the leads, compliance with data protection regulations , and competition with other companies to convert leads into customers.